1. Explaining Cryptocurrency Loans

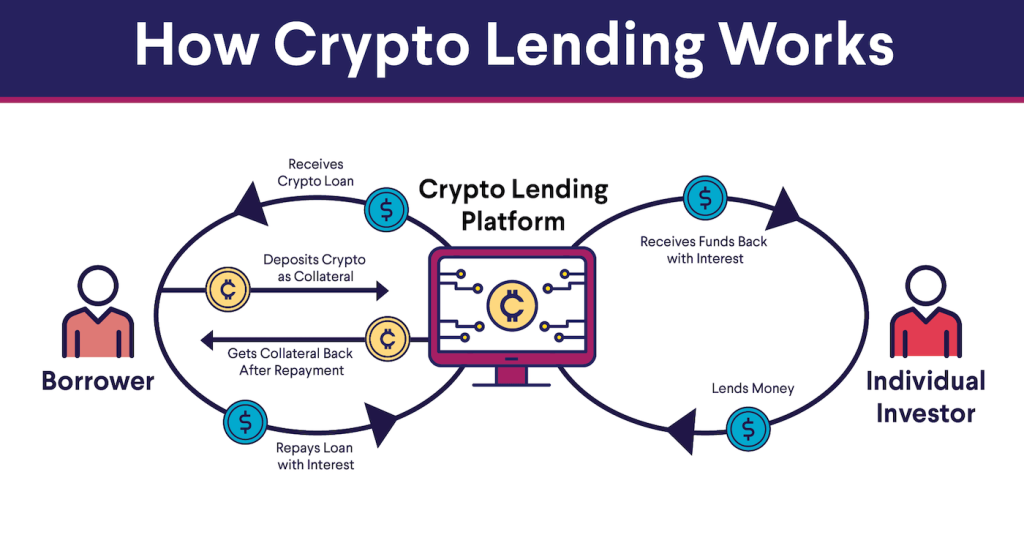

Crypto enthusiasts are often encouraged to “HODL” (HOLD) their assets—keeping them secure in a wallet until the value of their cryptocurrency increases. However, similar to the discomfort of keeping cash in a bank with low-interest rates, a common question arises: How can you increase your digital assets?This is where the field of cryptocurrency lending comes into play. It not only allows those with funds to earn interest from holding Bitcoin, but also enables borrowers to unlock the value of their digital assets by using them as collateral for a loan.In investments, one of the significant challenges is cash flow—and nothing is worse than having your capital tied up in assets with short-term fees and low liquidity.

2. Borrowing Bitcoin

Let’s imagine that Steve has 2 BTC. He doesn’t want to sell any of them because he is confident that their price will increase significantly. However, he is concerned that if he holds onto the cryptocurrency, there’s a risk that its value might decrease one day.

A cryptocurrency lending platform can address this issue. Typically, Steve would have the opportunity to use his Bitcoin as collateral and receive a loan in stablecoin. Due to the volatility of digital assets, he often has to “over-collateralize,” meaning he has to invest more BTC than the total value of the loan he receives.

When he repays the loan, along with interest, his cryptocurrency will be returned in full—and he will ultimately have a substantial profit if BTC rises as he predicts. His cryptocurrency is only at risk if he fails to meet the loan term or if the value of the held Bitcoin as collateral drops below the value of the loan he received.

3. How did cryptocurrency lending start?

So… when did cryptocurrency lending take off? Well, it was around the time when economies stagnated in 2020 due to the pandemic. This period saw high-interest rates plummet, and borrowing for high-priced items quickly declined. Many sought alternative ways for their assets to generate profit. Cryptocurrency became a quick and easy way to gain almost instant access to various legal tenders. Suddenly, it was a time when Bitcoin and Litecoin were not used on exchanges or cold wallets.

Unlike traditional personal loans or credit cards, secured loans are much safer for lenders. Therefore, borrowers can take advantage of lower interest rates.

4. Benefits of Cryptocurrency Lending

One key advantage that many see in cryptocurrency lending is that, unlike traditional banks, you won’t be credit-scored. This means that borrowing may be more accessible for those without financial histories, consumers without bank accounts, and freelancers struggling to get credit due to their unstable income. Payments are also more flexible.

For traditional finances, it might take several days for parties to receive the loan. Meanwhile, cryptocurrency borrowers can receive BTC loans almost instantly. You can also make your assets more liquid without triggering a taxable event—and you can adjust the loan to suit your needs. Users can also switch between various cryptocurrencies, so you can lend in Ether and borrow in Tether on the same platform.

5. How to Get a Bitcoin Loan

If you want a BTC loan but don’t know where to start, you have two main options: centralized and decentralized lending platforms.

Centralized Cryptocurrency Lending Platforms

Ecosystems like BlockFi, Nexo, and Binance have to comply with certain rules and procedures. You’ll need to create an account by registering with your chosen platform and undergo Know Your Customer (KYC) procedures to prevent fraud and money laundering.

These platforms usually have on-chain protocols to ensure the safety of your collateral. Some platforms protect cryptocurrency assets through insurance or keep the majority of digital assets in their cold storage, meaning they are far removed from internet connections.

Binance Cryptocurrency Lending

Binance offers cryptocurrency loans for users looking to borrow stablecoins like BUSD and USDT, leading cryptocurrencies like BTC and ETH, and various other cryptocurrencies on the Binance lending platform. Collateral assets for loans can be BTC, ETH, BNB, and other cryptocurrency assets. The initial Loan-to-Value (LTV) is 65%. An important thing to note for interested parties is the margin call, which occurs at 75%, and the liquidation LTV at 83%.

Loan terms are 7, 14, 30, 90, and 180 days, with interest calculated hourly. Binance users can choose to repay the loan before the term ends, but the interest will be rounded to the nearest hour. As of September 9, 2021, the hourly interest rate is 0.001667%, accumulating hourly once users successfully borrow cryptocurrency assets.

6. BlockFi Cryptocurrency Lending

BlockFi was established in 2017 to provide credit services to markets without access to simple financial products, offering top-notch rates and institutional-grade services. BlockFi’s main product is its interest account, allowing users to earn an 8% Annual Percentage Yield (APY) by lending their cryptocurrency assets. BlockFi also offers cryptocurrency loans with low-interest rates, down to 4.5% APR.

However, BlockFi’s cryptocurrency loans have higher requirements than Binance. For newcomers, the minimum loan amount is $10,000. Furthermore, the LTV is lower, meaning it’s stricter, at 50%, and the margin call is at 70%. However, BlockFi users can receive their loan on the same business day and have the option to prepay the loan, similar to Binance.

Is BlockFi Safe?

BlockFi’s primary supervisory bank is Gemini Trust LLC, a company regulated by the New York State Department of Financial Services. It also has notable institutional support from venture capitalists, including Galaxy Digital, Fidelity, SoFi, and Coinbase Ventures. However, BlockFi’s cryptocurrency accounts are not FDIC or SIPC insured. Additionally, three U.S. states—New Jersey, Alabama, and Texas—have banned BlockFi interest accounts, citing violations of state securities laws. Although this does not directly impact BlockFi’s cryptocurrency lending products, it may negatively affect users accessing BlockFi.

7. Getting a Cryptocurrency Loan Without Collateral

The second option for cryptocurrency lending is through a decentralized platform, abbreviated as DeFi.

Cryptocurrency loans without collateral, also known as unsecured cryptocurrency loans, are innovative financial services providing short-term liquidity and can be repaid in legal tender or cryptocurrency. The idea is to borrow money directly from lenders using cryptocurrency as collateral instead of traditional assets like stocks and gold. If you’re interested in an unsecured cryptocurrency loan or a collateral-free cryptocurrency loan, you can use some platforms. For example, vay nhanh is a popular example of collateral-free cryptocurrency loans, but they require you to have a high level of cryptocurrency knowledge to navigate.

Before proceeding with any unsecured cryptocurrency loan, conduct thorough research and ensure that the platform you choose is legitimate.

What is Decentralized Finance (DeFi) Lending?

DeFi lending platforms are entirely decentralized, and transactions are processed by code rather than humans. On services like Aave, Compound, and dYdX, smart contracts use algorithms and protocols to automate loan payments.

Anyone can access these protocols on a decentralized financial platform, making them completely transparent, as nothing can be hidden on the blockchain. Unlike CeFi platforms, there is no intermediary or financial regulatory authority, meaning you don’t have to go through verification processes like KYC. However, DeFi interest rates for cryptocurrency loans tend to be less competitive than what centralized financial counterparts can offer.

You can receive a BTC or ETH loan—or any other type of cryptocurrency loan—very quickly because you won’t need to exert any effort. Thanks to smart contracts, all users need to do is register for a loan and then send the cryptocurrency they want to use as collateral to a designated wallet related to the lending platform.

Users of decentralized lending platforms can apply for a large loan of any size without confirming their identity to a third party. Loans can be supported by stablecoins like USDC, legal tender, or cryptocurrencies like Ethereum or BTC.

8. Should You Borrow Cryptocurrency?

In both centralized and decentralized lending platforms, you have the option to open a savings account with decent profit if BTC rises as he predicts. His cryptocurrency will only be at risk if he fails to meet the loan’s deadline or if the value of the held Bitcoin drops below the value of the loan he received.

8.1. How did Cryptocurrency Lending Start?

So… when did cryptocurrency lending take off? Well, it was around the time when economies stalled in 2020 due to the pandemic. This period witnessed high-interest rates being cut sharply, and lending for high-priced items quickly declined. Many sought alternative ways for their assets to generate profit. Cryptocurrency became a quick and easy access point to almost instantly enter various legal tender currencies. Suddenly, those were the days when Bitcoin and Litecoin were not traded on exchanges or cold wallets.Unlike traditional personal loans or credit cards, collateralized loans are much safer for lenders. This allows borrowers to take advantage of cheap interest rates.

8.2. Benefits of Cryptocurrency Loans

One of the main advantages that many people can see in a cryptocurrency loan is that, unlike traditional banks, you won’t be assessed for your credit score. This means that lending can be more accessible for those with no financial history, consumers without bank accounts, and freelancers struggling to get credit due to their unstable income. Payment terms are also more flexible.For traditional finance, it may take several days for both parties to receive the loan. In contrast, loan recipients can receive BTC loans almost instantly. You can also make your assets more liquid without triggering a taxable event—and you can adjust the loan to suit your needs. Users can also switch between different cryptocurrencies, allowing you to send funds in Ether and borrow Tether on the same platform.

9. How to Get a Bitcoin Loan

If you want a BTC loan but don’t know where to start, you have two main options—centralized and decentralized lending platforms.

9.1. Cryptocurrency lending on centralized exchanges

Ecosystems like BlockFi, Nexo, and Binance must adhere to certain rules and procedures. You’ll have to create an account by registering on your chosen platform and undergo Know Your Customer (KYC) procedures to prevent fraud and money laundering.These platforms often have on-chain protocols to ensure the safety of your collateral. Some platforms protect cryptocurrency assets through insurance or hold most digital assets in their supervised cold storage, meaning they are offline and away from internet connections.Centralized cryptocurrency lending platforms will still record all deposits and withdrawals using blockchain technology visible to everyone, providing an excellent way to earn interest from Bitcoin, along with various other cryptocurrencies and stablecoins like USDC and DAI. Specifically, the best annual interest rate for a USD savings account at a bank hardly exceeds 1%, but many platforms offer cryptocurrency interest rates up to 8%. It’s worth doing something to get the best deal—and avoid fees above average.There are many paperwork procedures related to borrowing money through centralized financial platforms (CeFi), but the fact is that having a regulated environment—and a customer service just a click or a phone call away—makes these platforms more attractive to traditional investors.

9.2. Cryptocurrency lending on Binance

Binance offers cryptocurrency loans for users who want to borrow stablecoins like BUSD and USDT, leading cryptocurrencies like BTC and ETH, and many other types of cryptocurrencies on the Binance lending platform. Collateral assets for loans can be BTC, ETH, BNB, and other cryptocurrency assets. The initial loan-to-value ratio (LTV) is 65%. It’s essential to note the call margin, which occurs at 75%, and the liquidation LTV at 83%.Loan terms are 7, 14, 30, 90, and 180 days, with interest calculated hourly. Binance users can choose to repay the loan before the term expires, but interest will be rounded to the nearest hour. As of September 9, 2021, the hourly interest rate is 0.001667%, accumulating hourly once users successfully borrow cryptocurrency assets.

9.3. Cryptocurrency lending on BlockFi

BlockFi was established in 2017 to provide credit services to markets without needing access to simple financial products, offering top rates and quality institutional services. Its main product is its interest account, allowing users to earn an 8% annual profit (APY) by lending their cryptocurrency assets. BlockFi also provides cryptocurrency loans with low-interest rates up to 4.5% APR.However, cryptocurrency loans from BlockFi require higher commitments than Binance. For newcomers, the minimum loan amount is $10,000. Moreover, the LTV is lower, meaning it is more stringent, at 50%, with a call margin at 70%. However, BlockFi users will be able to receive their loan on the same business day and can prepay the loan, similar to Binance.

9.4. Is BlockFi Safe?

BlockFi’s primary regulatory oversight is by Gemini Trust LLC, an LLC regulated by the New York State Department of Financial Services. It also has notable institutional support from investors such as Galaxy Digital, Fidelity, SoFi, and Coinbase Ventures. However, BlockFi’s cryptocurrency accounts are not protected by FDIC or SIPC. Additionally, three U.S. states—New Jersey, Alabama, and Texas—have banned BlockFi interest accounts, citing violations of state securities laws. While this does not directly affect BlockFi’s cryptocurrency lending products, it may negatively impact users’ access to BlockFi.

10. Getting Cryptocurrency Loans without Collateral

The second option for cryptocurrency loans is to go through a decentralized platform, abbreviated as DeFi.Cryptocurrency loans without collateral, also known as unsecured cryptocurrency loans, are innovative financial services that provide short-term liquidity and can be repaid in legal tender or cryptocurrency. The idea is to borrow money directly from the lender using cryptocurrency as collateral instead of traditional assets like property and gold. If you are interested in an unsecured cryptocurrency loan or a loan without collateral, you can use some platforms. For example, instant loans are a common example of unsecured cryptocurrency loans, but they require you to have a high level of cryptocurrency knowledge to navigate.Before proceeding with any unsecured cryptocurrency loan, conduct thorough research and ensure that the platform you choose is legitimate.

Cre: coinmarketcap

Discussion about this post